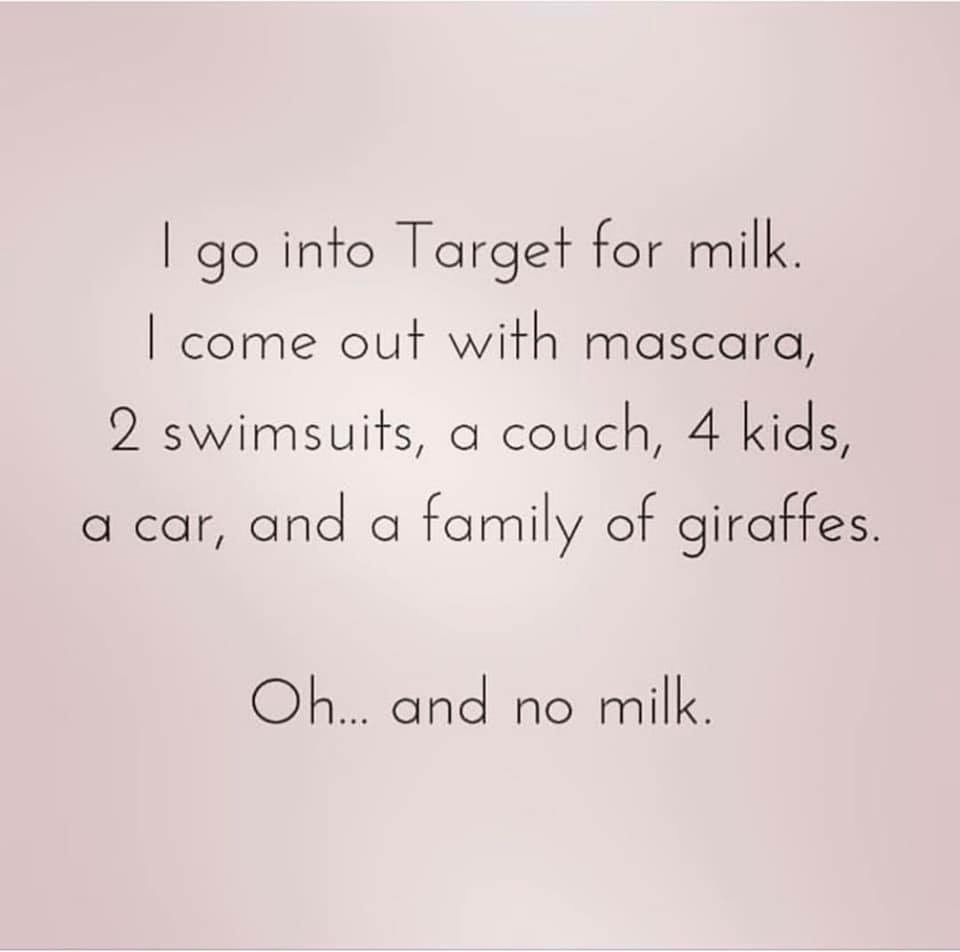

I came across the above image on facebook a few days ago and think it points to a major hindrance of wealth accumulation. The comments section for the image was filled with numerous people telling stories of how they have bought numerous items for which they did not go to the store. I would define this hindrance to wealth accumulation as a lack of planning and/or a lack of sticking to the plan as one could argue they planned for milk.

I believe a lack of planning, or sticking to your plan, accounts for much of the unnecessary spending in people’s lives and I know it does in mine. There have been numerous times in my life where I failed to plan, and then had to use my hard earned money to cover my lack of planning. Examples include times I did not plan out my morning, or more likely did not stick to my plan by hitting snooze too many times, so instead of being able to walk or take public transit to work, I had to use uber/lyft. Times that I did not plan out my lunches for the week, so had to go out to eat. Times I did not plan my grocery list, so ended up spending more than I should because impulse shopping took over. This can also extend to much larger expenses. A lack of planning a vacation earlier in the year, so then having to spend large amounts on flights, when time spent planning a few months earlier could have saved hundreds. In our real estate business we had a time that we failed to plan a routine inspection of one of our HVAC units and that unit ended up breaking and having to be replaced costing thousands.

One of the most common types of planning that many people use is setting up a budget*. Hopefully as you have been tracking your expenses you are beginning to see a pattern of how much you spend a week in certain categories to use as a guide and potentially even see where you can cut expenses.

I believe a budget is especially necessary if you are attempting to pay off debt and/or build your emergency fund. To eliminate debt, or build an emergency fund, you need to know that you are going to have a set amount each month to throw at it, and having a budget will make sure you achieve that amount. As with tracking your net worth, technology has made budgeting a lot easier. Personal Capital does track spending to a point, but when it comes to budgeting and really seeing where your money is going I like the free app, Mint. Mint will also track your net worth, but to me the combination of the two apps is a slam dunk. While I have not used it personally, I have also read very good things about the YNAB (You Need A Budget) app and website. The main reason I personally am leery of YNAB is that it is a paid app, but as they say on their website if they are what it takes for you to save hundreds a month and thousands a year, the investment is worth it.

I believe to truly save money the planning needs to extend to every area of your life. One thing that is focused on a lot in the FI community is optimizing your life and one of the major reasons for that is the more optimized something is, the more efficient it is. I was listening to a podcast recently where someone was able to greatly reduce their grocery budget just by tracking what items they were throwing away as they spoiled and making a plan to use those items earlier. Others have saved time and money by planning all of their errands/grocery trips into one or two days, as opposed to running out whenever they had a whim.

How much of your money are you spending to treat yourself because you are stressed out or feel overwhelmed by everything you have to accomplish? How much of that stress could be eliminated if you took an hour at the beginning of each week or month to plan your budget, plan your grocery trips, plan what you are going to wear, etc? Believe me I know that these things are not the exciting/sexy things that one wants to hear about accumulating wealth, but just as with professional athletes, it’s game plans and training/nutrition plans that allow them to be so exciting during the game. It is having continuously practiced the basics that allows them to succeed.

The other reason I harp on these systems so much is as JD Roth of Get Rich Slowly says, “…action creates motivation.” As I have mentioned numerous times I fought doing a lot of these things, but it was in finally taking the action to put these plans and systems in place that gave and continues to give me the motivation to continue down the path of frugality.

As always I am here to help!

*Full Disclosure: I personally do not have a budget in the normal sense, but I do have a plan. As I mentioned in my expenses article I try to stay under my per diem each week with my expenses. I also have amounts automatically deducted from my paycheck each week to go to my 401K, amounts deducted from my bank account each week to go to various investment accounts, and still have money left over to pay off my credit cards each month. Again, this is your journey, make the plan that works for you!!